Bottom Line Up Front (BLUF): The AI revolution will be throttled by three physical constraints: compute (35,000 chip packages per month), energy (4-7 year grid connections), and humans (18-month+ approval cycles). But scarcity alone doesn't tell the whole story. These resources concentrate through gravity wells—scarce assets flow to whoever can pay the most and deploy the fastest, creating winner-take-all dynamics. This new economic reality means atoms constrain bits, physics beats algorithms, and the companies controlling these choke points will shape AI's trajectory for the next decade. The future belongs not to those with the best models, but to those who control the pipes.

Alephic Newsletter

Our company-wide newsletter on AI, marketing, and building software.

Subscribe to receive all of our updates directly in your inbox.

The Physics of AI Value

On September 20, 2024, Microsoft agreed to pay nearly double market rates for electricity from a nuclear plant most people thought was dead. This isn't desperation. It's the new economics of AI, where physical bottlenecks matter more than algorithms.

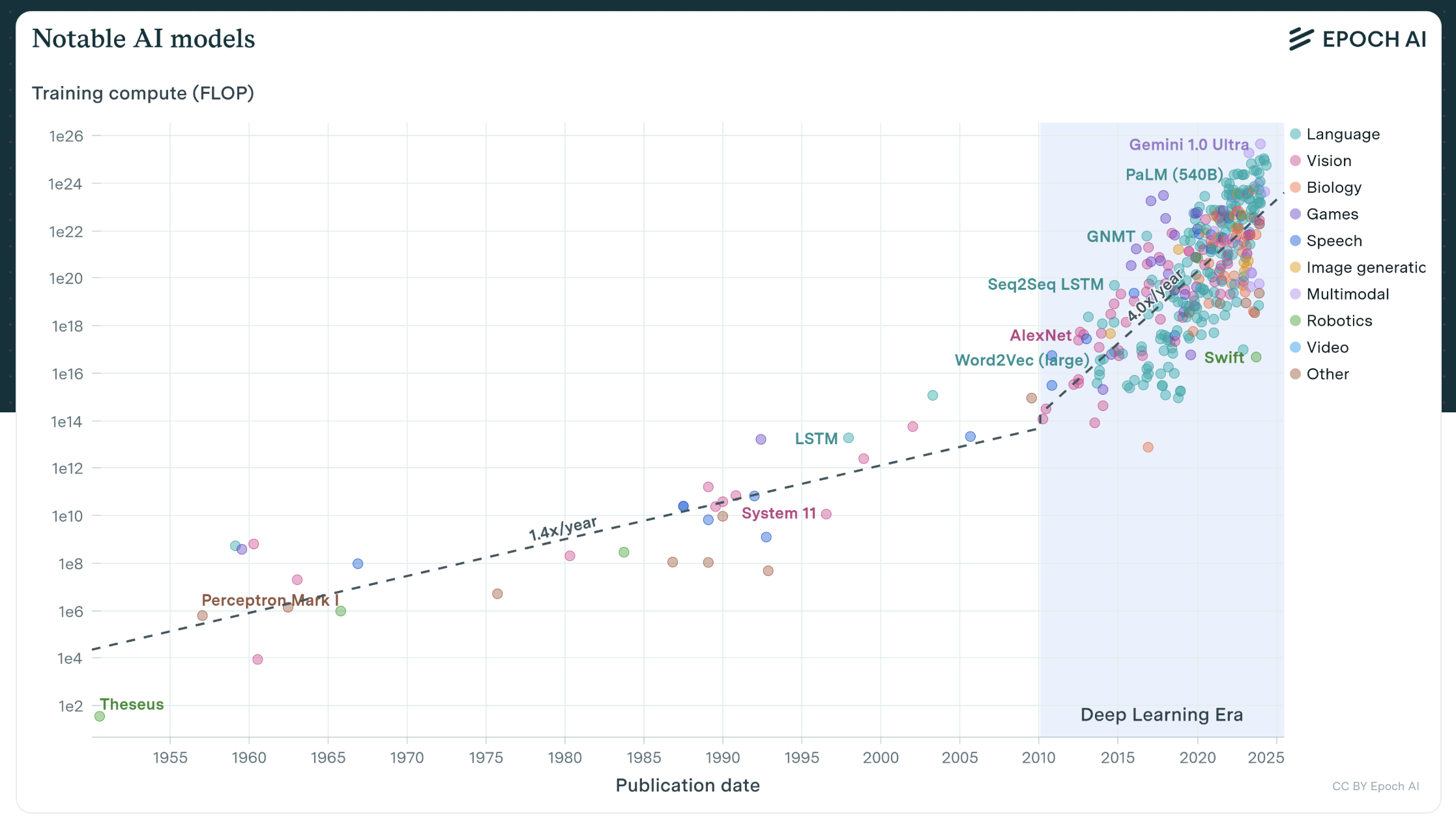

AI models double in capability every six months. Meanwhile, three and a half decades passed between America's last nuclear construction start and Vogtle breaking ground in 2013.

TSMC can only package 35,000 advanced GPU wafers per month. The US added 63 GW of capacity in 2024 — about 5% growth, while AI-driven data-centre electricity demand is projected to rise by up to 165% by 2030. Enterprise AI faces a bureaucratic gauntlet: governance committees that need 3 months to approve a pilot, automation projects that take 12-18 months from kickoff to deployment, and a success rate so dismal that 92% of companies remain trapped in "pilot purgatory," unable to scale beyond experiments.

The entire AI revolution depends on three physical bottlenecks that money alone can't fix. Every enterprise running AI agents, every startup training custom models, and every hedge fund running inference at scale must pass through these gates. The companies that own them will collect rent on the future.

Here's how.

Three Cascading Bottlenecks

Compute: The Packaging Crisis Nobody Sees

We can make chips faster than we can make them useful.

"The limiting factor for our growth is advanced packaging, not chip production," Jensen Huang admitted in Nvidia's Q3 2024 earnings call. TSMC can fabricate GPU processors by the millions, but their CoWoS—the technology that lets GPUs talk to memory fast enough for AI—crawls along at just 35,000 wafers per month.

The demand side tells a different story. Training compute has been doubling every 5–6 months since 2010. Today's largest models require 100 times more compute power than two years ago. By 2030, Epoch AI projects that inference will consume 5–10 times more compute than training.

The scarcity shows in pricing. Nvidia's H100 GPUs retail for $30,000 but have resold for up to $100,000 on secondary markets—a 3x premium that reveals actual demand. Yet, packaging capacity expands linearly: from 35,000 to 140-150,000 wafers monthly by 2026. Demand already exceeds 2027 projections. Nvidia alone could consume the entire output.

Why can't they just build more? Because advanced packaging requires different equipment, processes, and expertise than chip fabrication. You need silicon interposers with through-silicon vias (TSVs) to connect chips and memory. You need ultra-precise alignment tools to achieve the 36-micron pitch connections. You need engineers who understand thermal management at multi-die interfaces—a challenge that gets exponentially harder when integrating 8, 10, or 12 dies. TSMC launched Chip on Wafer on Substrate (CoWoS) as early as 2009 and began mass production in 2012, having perfected this technology over a decade. Intel's Foveros and Samsung's X-Cube remain years behind, with Samsung's I-Cube having only one major customer (Baidu) compared to TSMC's dominance with Nvidia and AMD.

The HBM (High Bandwidth Memory) bottleneck compounds the problem. HBM is memory that sits directly on the chip, similar to RAM attached to your processor. Only three companies can make it: SK Hynix (46-49% market share), Samsung (40% share, but struggling to get their chips approved by customers like Nvidia), and Micron (4-10% share). Each new generation requires tighter integration with packaging. This dual constraint creates the ultimate chokepoint: every AI accelerator needs both advanced packaging and high-bandwidth memory. No exceptions.

Solve packaging, and you hit an even harder wall...

Power: When Electrons Become the Bottleneck

"We've largely solved the GPU shortage. Now, energy is our primary constraint for scaling AI infrastructure," Mark Zuckerberg admitted in Meta's January 2025 earnings call. The numbers back him up: data centers could consume 9% of total U.S. electricity by 2030—more than double current usage. The increase alone would equal 20% of Japan's entire electricity consumption.

The scale becomes tangible at the facility level. Today's AI data centers already draw 50–100 MW each, with the largest around 150 MW. AI training could demand up to 1 GW in a single location by 2028, equivalent to powering 750,000 homes.

Yet grid connections crawl. Nevada alone has 146 GW stuck in interconnection queues—enough to power 100 million homes. Nationally, 2.6 TW awaits connection. Only 14% of the capacity in interconnection queues from 2000 to 2018 has been built. The rest die waiting.

Why can't they just connect? Because grid infrastructure requires different timelines than software. You need upgraded transmission lines, new substations, and environmental permits. The Lawrence Berkeley National Lab found average connection times of 4-7 years. In AI time, that's an eternity.

The desperation shows in the deals being struck. Amazon bought a data center campus with direct nuclear access. Google signed the world's first corporate agreement for small modular reactors. They're not betting on proven solutions—they're buying lottery tickets on any path to power, no matter how speculative.

The scale of tech desperation reveals itself in the Small Modular Reactor (SMR) agreements. Amazon's $500 million investment in X-energy aims to deploy 5 GW by 2039. Google's 500 MW agreement with Kairos Power targets the first deployment by 2030. These companies are betting billions on unproven technology, which NuScale—the only US SMR design with regulatory approval—has just demonstrated costs $89/MWh, versus $20-50/MWh for renewables.

Yet even these moonshot bets face reality. SMR manufacturing requires specialized facilities—only a handful of companies worldwide can manufacture reactor pressure vessels. International deployments show familiar patterns: China's HTR-PM took 10 years longer than planned,and Russia's floating reactor experienced 9 years of delays. The optimistic "early 2030s" timeline for commercial deployment means tech giants must solve their power crisis with existing infrastructure for at least another half-decade.

This physics constraint explains why Microsoft and BlackRock launched their $30 billion Global AI Infrastructure Investment Partnership, with the potential to mobilize $100 billion.

Yet even with chips and power, there's one bottleneck money can't fix.

Talent: The Human Bandwidth Crisis

We can't package chips fast enough. We can't connect the power fast enough. However, there's a third bottleneck that exacerbates both problems: we can't make decisions quickly enough.

The binding constraint on AI deployment isn't just physical infrastructure—it's organizational velocity. While TSMC struggles to expand packaging capacity and tech giants scramble for nuclear deals, most enterprises are still debating committee structures while their competitors ship production code.

The $3 Trillion Friction Tax

The numbers reveal institutional sclerosis on a large scale. Harvard Business Review quantified what every enterprise feels: bureaucracy costs the US economy $3 trillion annually, 17% of GDP. In tech, the damage is more acute. Managerial and administrative roles have ballooned to one administrator for every four to seven frontline workers, up from ratios of 1:10 in the 1980s.

This isn't just overhead—it's a physics constraint on innovation velocity. When DocuSign employs 6,840 people to manage digital signatures while entire AI companies reach nine-figure revenues with dozens, we're witnessing two different species of organization. One moves at the speed of committees—the other moves at the speed of code.

The evidence is everywhere:

- Amazon's builder ratio mandate: 15% improvement required across all divisions

- Microsoft's 10,000-person reduction: Explicitly to restore "organizational agility"

- Google's restructuring: Entire divisions reorganized for speed

- Meta's "year of efficiency": 21,000 roles eliminated to accelerate shipping velocity

These aren't cost-cutting measures. They're physics experiments in organizational acceleration.

Conway's Law as Destiny

In 1968, Melvin Conway observed that organizations "are constrained to produce designs which are copies of their communication structures." For fifty years, this meant your org chart became your architecture. Your approval chains became your user experience. Your bureaucracy literally encoded itself into your products.

AI doesn't just work around Conway's Law—it makes traditional organizational structures obsolete. When AI agents can coordinate without meetings, when natural language replaces rigid APIs, when a single person with AI can do the work of entire departments, the fundamental premise of hierarchical organization collapses.

Sam Altman crystallized this shift in 2023: "In my little group chat with my tech CEO friends, there's this betting pool for the first year that there is a one-person billion-dollar company. Which would have been unimaginable without AI—and now [it] will happen."

This isn't an efficiency gain. It's a new species. Traditional structures assume human bandwidth constraints: managers exist because humans can only coordinate with 5-7 direct reports. Departments exist because specialization was mandatory. Approval chains exist because information couldn't flow freely.

AI eliminates these constraints. But most organizations are still structured for a world where they existed, like building highways after inventing teleportation.

The Velocity Arbitrage

Here's where the gravity well dynamic becomes decisive. Companies that achieve algorithmic efficiency with human teams don't just get first access to scarce chips and power—they can actually deploy them before competitors finish their planning cycles.

Consider the math:

- Traditional enterprise: 18-month pilot → 12-month rollout → 6-month optimization = 36 months to value

- Velocity-optimized org: 2-week prototype → 4-week deployment → continuous iteration = 6 weeks to value

That's a 24x advantage in learning cycles. In AI time, where models double in capability every six months, slow organizations are perpetually two generations behind.

The counterexamples prove what's possible:

- Midjourney: $200M ARR with under 100 employees—no sales team, no marketing department, pure product velocity

- Cursor: $100M ARR with 20 people, outmaneuvering Microsoft's 220,000

These aren't just lean startups. They're existence proofs that small teams with AI leverage can outperform giants with 1,000x more resources.

The Zero-Friction Organization

Traditional organizational structures are artifacts of pre-AI constraints. Why have three levels of management when AI can coordinate directly? Why maintain rigid department boundaries when AI agents can fluidly collaborate across domains? Why preserve approval chains designed for human processing speeds?

AI acts as an organizational superconductor, eliminating resistance between human judgment and machine execution. It enables structures that were previously physically impossible: dynamic teams that form and dissolve per task, decision-making that scales horizontally instead of hierarchically, and coordination without communication overhead.

Traditional software demanded you conform to its structure. Traditional organizations demanded the same. AI enables structure to emerge from the work itself, reforming moment by moment based on what needs to be done, with 10 times or 100 times fewer people than before.

The implication is stark. When execution friction approaches zero, when AI handles coordination overhead, when decisions flow at the speed of thought, traditional organizational mass becomes pure liability.

The companies that win won't be those with the most engineers. They'll be those who achieve the highest velocity with the smallest surface area. In an AI-accelerated world, organizational friction doesn't just slow you down—it makes you obsolete. Every management layer, every approval process, every coordination meeting is a competitive disadvantage that compounds daily.

This creates a triple lock on AI's future. Scarce packaging capacity flows to whoever can pay. Scarce power flows to those locked in contracts years ago. However, both advantages are negated if you can't deploy quickly enough to capture value. The companies that win all three—compute, power, and velocity—don't just get resources. They get to define what resources are worth.

Gravity Wells

When TSMC adds packaging capacity, it doesn't get distributed fairly. Apple takes first dibs on M-series chips, Nvidia fights for what's left, and AMD scrambles for scraps.

When a nuclear plant comes online, it doesn't power the grid. Microsoft or Meta locks it up with a 20-year contract.

When top AI engineers leave Google, they don't scatter across startups. They concentrate at Anthropic, OpenAI, or start their own labs.

This is the dynamic of the gravity well: scarce resources flow to whoever can pay the most and deploy the fastest. Three types of companies have positioned themselves at these choke points, each exploiting scarcity in a distinct manner. They don't compete for resources—they control how resources get allocated.

Three Winners

Foundation models grab every GPU that comes online and turn it into capability gaps competitors can't close. Accretive software platforms absorb every model improvement as pure margin—no engineering required. Infrastructure gatekeepers sit at the physical choke points and set their own prices.

Each type compounds its advantage differently. Each becomes harder to displace over time. And that's precisely what makes them investable. While startups fight for scraps, these companies get first pick of every freed resource.

Foundation Models: The FLOP Black Holes

A handful of organizations dominate enterprise large language model (LLM) traffic. OpenAI, Anthropic, Google, Meta, and a handful of Chinese labs don't just build AI companies—they build compute black holes that grow stronger with every GPU they consume.

OpenAI's Inference Industrial Complex

OpenAI burned through $5 billion to generate $3.7 billion in revenue in 2024, operating 350,000 Nvidia A100 servers just for inference. Yet they command a $300 billion valuation as of April 2025.

The logic echoes Rich Sutton's bitter lesson: "The biggest lesson that can be read from 70 years of AI research is that general methods that leverage computation are ultimately the most effective, and by a large margin." Every efficiency gain flows directly into training larger models, not improving margins. When Nvidia releases H200s with 141GB of HBM3e memory—nearly double the H100's capacity—OpenAI doesn't pocket the savings. They train a larger model. When inference costs drop 10x, they serve 10x more queries.

The network effects are brutal. Better models attract more users. More users generate more revenue. More revenue buys more compute. More computing trains better models. The cycle accelerates.

The scale of ambition reveals itself in unprecedented infrastructure commitments. In January 2025, OpenAI, Oracle, and SoftBank announced Stargate—a $500 billion AI infrastructure project that dwarfs the GDP of entire nations. They're already pouring concrete in Texas, with 10 data centers under construction, each spanning 500,000 square feet. The initial $100 billion deployment alone exceeds what most countries spend on their entire infrastructure in a decade. This isn't a plan or a proposal—it's capital allocation at a scale that redefines what "compute investment" means.

Accretive Software: Riding the Intelligence Wave

Most AI software competes with advances in AI. Smart platforms surf them.

The distinction is crucial. Competitive software fights each model improvement—their moats erode with every API update. Accretive software absorbs improvements automatically. Model advances become margin expansion—no product changes required.

The Zero-Code Margin Machine

Tesla replaced 300,000 lines of C++ code with 3,000 lines that activate neural networks. That's the future of software: massive capability gains with radical simplification. Now, imagine applying that principle to business models.

When Mistral released its sparse mixture-of-experts architecture, activating only 13 billion parameters despite having 47 billion total, platforms didn't need to rewrite anything. They swapped models through existing APIs. Customers got 47 B-parameter quality, while platforms incurred 13 B-parameter compute costs. Whether platforms lower prices, expand usage, or capture margin, every efficiency gain strengthens their position.

This pattern repeats everywhere:

- Tesla FSD collapsed 300,000 lines of driving logic into neural networks. Each model improvement now deploys instantly—no code changes required.

- Palantir AIP supports OpenAI, Anthropic, Meta, and xAI models interchangeably. Users switch models in Pipeline Builder based on specific use cases, eliminating the need for re-engineering.

- Vercel v0 upgraded from Claude Sonnet 3.5 to Sonnet 4.0. Error-free generation jumped from 64.71% to 93.87%. Their pricing stayed identical—pure margin expansion.

The evolution is inevitable: from swapping models to routing queries in real-time. Vercel already routes simple edits to models 40x faster than GPT-4o-mini, while complex tasks hit frontier systems. Glean's platform auto-selects from 15 LLMs based on each task's requirements.

The endgame? A compute exchange where every query finds optimal price-performance routing. Where model providers compete on microsecond latency and fractional cent pricing. Where enterprises never directly access model APIs.

The business model is antifragile. Every breakthrough in model efficiency, every new open-source release, and every API price war make these platforms stronger. They're selling picks and shovels, but the picks sharpen themselves.

That's not software. That's infrastructure for the AI age.

Infrastructure: The Physics Toll Collectors

You can't download a fab. You can't fork a power plant. You can't digitize an electron.

While software scales infinitely, the physical layer scales linearly—or not at all. This creates natural monopolies at every choke point in the AI stack. The companies sitting at these gates don't compete on code velocity. They compete on mastering the physical world—atoms per wafer, electrons per datacenter, years to build.

Advanced Packaging

One company controls 90% of the technology that makes AI chips work. They raised prices by 20% last year. No customer defected—there's nowhere else to go.

The desperation manifests in unprecedented moves. Apple's COO makes secret visits to Taiwan, booking 2nm capacity years before production. NVIDIA diversifies to secondary suppliers like Amkor and UMC—not because they're better, but because any capacity beats no capacity. Some switch entire packaging architectures mid-stream, moving from CoWoS-S to CoWoS-L just to secure supply.

Power

Tech giants now pay 2- 4x market rates for guaranteed electrons. Microsoft didn't revive Three Mile Island for nostalgia. They did it because a single hour of downtime costs more than a year's power bill.

The scramble reveals deeper physics: data centers could consume 9% of US electricity by 2030. That's Japan's entire consumption added to global demand. Yet grid connections take 4-7 years. Nevada alone has 146 GW stuck in interconnection queues—enough to power 100 million homes, gathering dust.

Critical Materials

A single AI datacenter needs thousands of tons of copper. The infrastructure buildout will consume millions of tons. The companies mining it set their own terms.

These aren't technology companies. They're toll collectors on the only roads to the future. Their moats are measured in construction years and billions of capital. Their pricing power comes from physics, not features.

The endgame is vertical integration. Why pay someone else's margins when you can own the electrons? Oracle builds power plants adjacent to data centers. Amazon funds entire nuclear facilities. Microsoft and BlackRock launched a $30 billion infrastructure partnership, with the potential to mobilize $100 billion. The future of AI infrastructure isn't just compute—it's owning every link in the chain from uranium to GPU.

The Coming Disruptions

History whispers its lessons: every generation's immutable constraint becomes the next generation's solved problem. Aluminum commanded gold's price until the advent of electrolysis made it commonplace. Bandwidth choked innovation until fiber made it infinite. Computing power itself was precious until transistors made it ubiquitous.

Today's physics bottlenecks—the packaging limits, the power constraints, the human friction—feel permanent because they are physical. But physics has always been negotiable, given enough intelligence applied to the problem.

The next decade will witness history's greatest resource arbitrage. Those who control today's scarce atoms—the wafers, electrons, and decision-makers—will shape how intelligence itself evolves. They'll determine which ideas get computed, which companies get power, and which innovations see the light.

But this isn't a story about eternal monopolies. It's about transition states. The most fascinating moment won't be when these constraints bind tightest, but when they begin to crack—when someone figures out optical computing, when room-temperature superconductors arrive, when organizations achieve zero coordination overhead, when AI systems learn to design their own infrastructure.

The companies positioning themselves at these choke points aren't just collecting tolls—they're funding the research that will eventually render them obsolete. TSMC's packaging monopoly funds the photonics research that could eliminate the need for packaging. Nuclear moonshots teach us about distributed energy. Today's organizational friction accelerates tomorrow's autonomous systems.

We stand at a unique moment: bright enough to see the constraints, not yet clever enough to route around them all. The gap between what intelligence wants to do and what physics allows creates the defining economic dynamic of our time.

Physics always wins—until it doesn't. And then everything changes.