When Noah and I were first starting Percolate, one thing I really enjoyed doing was pitching our vision for what we wanted to do. In 2010, that was helping marketers build and develop their content for social.

Alephic Newsletter

Our company-wide newsletter on AI, marketing, and building software.

Subscribe to receive all of our updates directly in your inbox.

More than one very smart person told me they didn’t think it was a good idea because it wasn’t that big of a problem, and social media was a bubble. Thank goodness we didn’t listen, but I’m reminded 14 years later why that was a valid objection.

In 2010, Facebook was worth $15B dollars, valued privately by a late stage private investment by Microsoft that many thought was bonkers. Twitter, as a second example, couldn’t figure out how to monetize. I was even part of a team at Federated Media that built the first ad API execution/ad business model for Twitter, and given the dysfunction of that work, I was a bit skeptical.

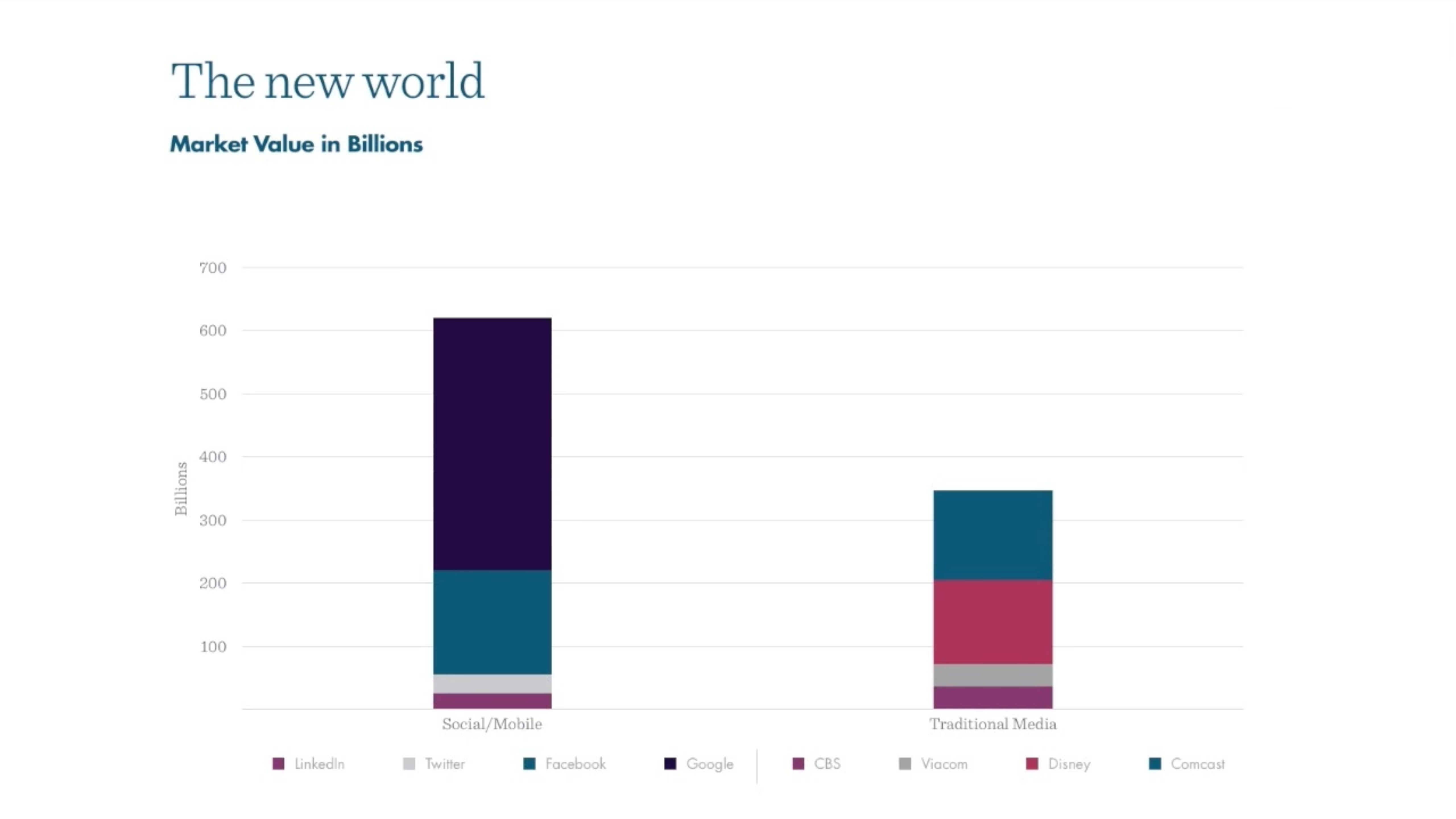

But, by 2013, the world had changed pretty dramatically. By then, I was excited to show people who were once naysayers and bubble prophets that, in fact, social media had taken over the world. I did that by showing the valuations, both public and private, of social media companies. In fact, if you added up all the social media companies, the market would very clearly signal that just a few social companies were worth more than all traditional media companies combined. I lost the original slides, but there is this talk on YouTube and a snapshot of the slide:

This slide had the opposite effect of what I was trying to say. Again, it led many people to argue that social media was in a bubble. “Facebook can’t possibly be worth more than Viacom, Disney, etc, combined?!,” they cried. Well, Meta, née Facebook, is now worth 18x more than when this slide was created and is way bigger than all those other companies combined. There are clearly no remaining questions in marketing departments around the world about Meta being far more important and strategic than their traditional alternatives. The learning lesson for me was to understand and dig into the market, which was clearly telling us that what was happening at Facebook was special and should be studied—bubble or not.

Something similar is happening now.

Pascal’s Wager in AI

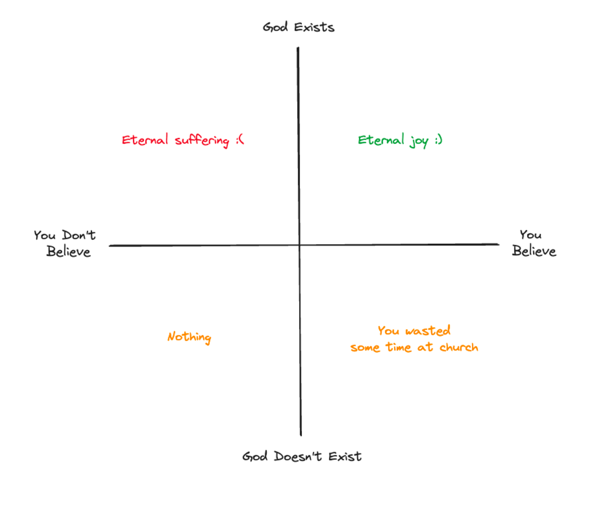

Pascal's wager is a philosophical argument from Blaise Pascal, who argued that believing in God was rational due to the potential infinite reward versus finite loss. Blaise’s argument was pretty simple: God either exists or doesn’t, and the only real downside case comes from the scenario where God does exist, and you aren’t a believer.

Many look at what is happening today in AI and say the investment can’t possibly make sense. This includes even the best financial minds at Goldman, Sequoia, and Barclays who all recently put out reports that the current investments can’t possibly sustain. But I like how Doug Clinton, a financial analyst at Deepwater Asset Management, applied the Pascal Wager to AI investments by big tech companies.

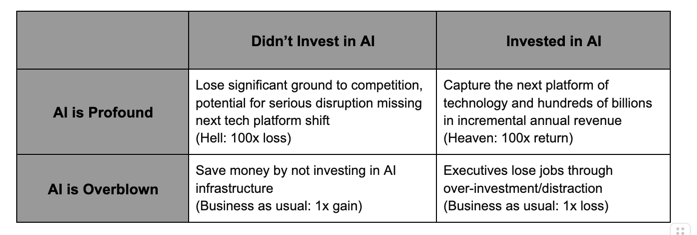

Just as Pascal argued that believing in God was a rational choice due to the potential infinite reward versus finite loss, tech companies are applying similar logic to their heavy AI investments. The wager for these hyperscalers can be broken down as follows:

Just as with Pascal’s Wager, the only truly terrible outcome comes in the top left box where AI turns out to be profound, but a company didn’t invest. The asymmetry of outcomes makes the decision to invest heavily in AI a rational choice, even if the probability of success is uncertain. The potential upside of being at the forefront of a transformative technology far outweighs the downside of wasted investment.

What are the Lessons for Marketers and Enterprises in this Wager?

- Don't dismiss transformative technologies: Just as some dismissed social media in 2010 and even 2013, many are skeptical of AI's potential today. History shows that underestimating technological shifts can be costly.

- Follow the money: While not infallible, market valuations can signal where smart money is betting. The massive investments in AI by tech giants and venture capital firms indicate a strong belief in its potential.

- Strategic positioning: Even if you're skeptical about AI's immediate impact, positioning your company to take advantage of AI advancements can be a prudent strategy. This might involve upskilling your workforce, experimenting with AI tools, or integrating AI into your products and services.

- Balanced approach: While the Pascalian Wager argument suggests going all-in on AI, a more nuanced approach for most companies would be to invest strategically while maintaining core business strengths.

- Learn from the social media revolution: The rapid rise of social media companies and their impact on traditional media should serve as a case study for the potential of AI to disrupt established industries.

The Wager is On

Like the early days of social media, the AI investment boom is marked by excitement and skepticism. While it's easy to dismiss the hype, the Pascalian Wager framework provides a compelling argument for why major tech companies are making such significant bets on AI.

Ask yourself: How might AI reshape your industry similarly to social media's impact on marketing? What's your AI wager?

The wisest path forward is to engage with AI technologies, experiment with their applications in your field, and position your company to leverage AI-driven innovations. As we saw with social media, early adopters often reap the most significant rewards.

The downside if you’re wrong? You wasted some time at AI church.